ILAWASIA Recognized as Trusted Talent in 2025 Edition of IP STARS by Managing IP

Bangkok, Thailand – July 24, 2025 – ILAWASIA is proud to announce its recognition in the 2025 edition of IP STARS, a prestigious guide published by Managing IP that ranks the world’s leading intellectual property firms and practitioners.

This year, Managing IP introduced a new category called Trusted Talent, designed to spotlight firms that have demonstrated exceptional expertise through the achievements of their individual practitioners. ILAWASIA has been selected for inclusion in this new category, marking a significant milestone in the firm’s commitment to excellence in intellectual property law.

“We are honored to be featured in the Trusted Talent,” said Somphob Rodboon, a Managing Partner and leading IP practitioner at ILAWASIA. “This recognition reflects the dedication and expertise of our team, and our ongoing mission to deliver outstanding IP services to our clients across the region and the global.”

For over 25 years, IP STARS has been a benchmark for excellence in the IP industry, with rigorous research and analysis conducted by Managing IP’s team to identify top-performing professionals and firms worldwide

This recognition underscores ILAWASIA’s growing influence and reputation in the field of intellectual property, and its continued commitment to providing trusted legal counsel in a rapidly evolving global landscape.

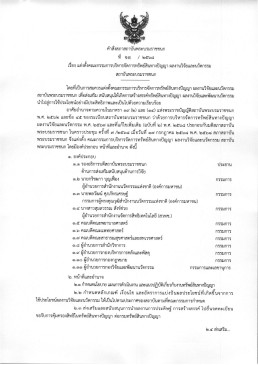

Pollawat Suppattarasaet Appointed to Prestigious Committee at Praboromarajchanok Institute

We are pleased to announce that Pollawat Suppattarasaet has been officially appointed as a member of the Committee on Intellectual Property Management, Research Works, and Innovation of the Praboromarajchanok Institute.

This appointment is made in accordance with Order No. 13/2568, issued by the Council of the Praboromarajchanok Institute, under the authority of the Praboromarajchanok Institute Act B.E. 2562 (2019). The committee plays a vital role in advancing the Institute’s mission to foster innovation, protect intellectual property, and promote impactful research across its academic and professional communities.

Mr. Suppattarasaet’s expertise and dedication are expected to contribute significantly to the strategic development and governance of intellectual property and innovation initiatives within the Institute.

We extend our heartfelt congratulations and best wishes for success in this important role.

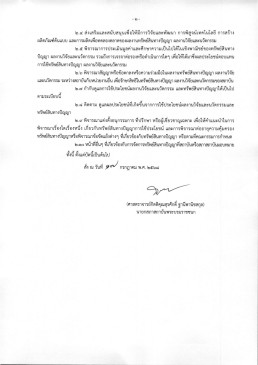

Pollawat Suppattarasaet Appointed as Arbitrator under Thailand’s Arbitration Act B.E. 2550

We are honored to announce that Dr. Pollawat Suppattarasaet has been officially appointed as one of the 23 arbitrators listed in the Notification of the Thailand Arbitration Institute No. 4/2568 (2025), dated 8 July 2025. This appointment is made in accordance with the provisions of the Arbitration Act B.E. 2550 (2007), recognizing Pollawat’s expertise and commitment to the advancement of arbitration and dispute resolution in Thailand.

This prestigious appointment reflects Pollawat’s extensive expertise, professional integrity, and commitment to upholding the principles of fair and effective dispute resolution.

His inclusion in this distinguished group of professionals underscores his standing in the legal community and his dedication to promoting justice and innovation in alternative dispute resolution.

We extend our sincere congratulations to Dr.Pollawat on this significant achievement and wish him continued success in this important role.

New Regional Guidelines on PDPA Whistleblower 2025 Released

Developed under a regional collaboration, ILAWASIA and partners have officially released the 2025 PDPA Whistleblower Guidelines—a collaborative publication presenting enforcement standards, data protection obligations, and liability risks under regulatory frameworks across Asia. We hope readers find this resource valuable for strengthening organizational compliance and risk awareness.

PDPA Whistleblower Guidelines 2025 – The guidelines have now been officially published and can be accessed via the following link: https://ilawasia.com/wp-content/uploads/ILAWAISA_PDPA-Whistleblower-2025-20250724.pdf