Announcement to New Myanmar Companies’ Registration

The Directorate of Investment and Company Administration (DICA) intends the companies to make a habit of complying with Myanmar Laws and in accordance with the legal requirements when conducting the business in Myanmar.

In order to verify whether the companies, directors and participants comply with relevant applicable laws and to support anti-money laundering and anti-terrorism financing procedures, according to section 97 of Myanmar Companies Law, a company must submit the following information when submitting the Annual Return that it is required to submit within two months after company incorporation.

| No. | Details |

|---|---|

| 1. | A bank account must be opened in the company’s name and evidence that the paid-up capital has been credited to the bank lists as shown in the Myanmar Companies Online (MyCo system). |

| 2. |

The Annual Return is required personal information of an individual who act as a director of the company.

|

| 3. | Recommendation from the relevant township police that the registered office address of the company mentioned in the MyCo system is actually located on the ground and the company is planning to open an office. |

| Remark (i) If a shareholder listed in the company’s registration is a natural person, it is required to submit the same evidences as mentioned in paragraph no.2; (ii) If a shareholder listed in the company’s registration is a legal person or legal entity, related company documents must be submitted as the evidence. |

|

Those who register a new company should fully comply with the above-mentioned points from the date of publication of this announcement which is 1st April 2023 and submit the Annual Return to company.dica@mifer.gov.mm.

Thereafter the Registrar will allow the submitting of the Annual Return that have to submit within 2 months after the company incorporation according to Myanmar Companies Law, section 97 and if there is no fully comply in relation to the submission of the Annual Return, further action will be taken according to Myanmar Companies Law, section 430 (d) as stated the register may give notice to the company that it intends to suspend the company’s registration, and such suspension will take effect within 28 days unless the company makes good the default including by the payment of any outstanding fees and prescribed penalties.

According to the above requirements from DICA, this can be concluded as following remark:

- The new investor is required more responsibility and requirements to incorporate a company in Myanmar than previous company registration system;

- The company’s office address must be an actual established address on the ground and the approval of the relevant department must be applied;

- If the director is a foreigner, the process of applying Form-C at the Immigration Department must be completed.

Therefore, the timeframe for the company’s incorporation should take longer than before.

We will certainly keep you apprised of any future developments in its regard. Should you need further information on Myanmar Companies Law, please drop us a line at corporate@ilawasia.com

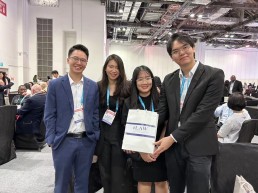

Discover our Exhibition Booth at World Litigation Forum 2023

On May 23-24, 2023, Somphob Rodboon (Managing Partner); Vicheka Lay (Partner); Kridtaporn Sirisereephap (Senior Associate); Kanyamol Phupapiew (Senior Associate); and Nannapas Phatcharakeatkanok (Senior Associate), attended the World Litigation Forum 2023 as exhibitor and sponsor of an event, at the Chengal Ballroom of Crowne Plaza Changi Airport, Singapore.

We are honored to be a part of this global gathering of litigators, arbitrators, attorneys, legal professionals, and practitioners. Let us embrace the power of collaboration and work together to advance the art of litigation and dispute resolution.

d-law firm Membership

ILAWASIA CO., LTD. has been admitted to d-lawfirm Membership of the Digital Economy Promotion Agency (depa) of Thailand, effective April 30, 2023, to April 30, 2026.

This recognition is in accordance with the Notification of the Digital Economy Promotion Agency regarding the Criteria for the Qualifications of Agencies Applying for Registration of Legal Services Providers, dated March 3, 2023, in which our firm met all legal requirements.

Networking with Thai Startup

On May 23, 2023, Thanapha Phetkeereeskul, IP Senior Associate; and Thanaphorn Kaewsukko, Corporate Associate, attended Makers United 2023 by Thai Startup, a seminar and networking party, at the Major Cineplex Ratchayothin & Blu-O Rhythm & Bowl, in order to discover new business opportunities for SMEs and start-up industry.

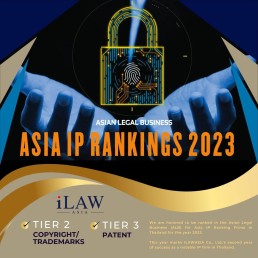

ALB: Asia IP Ranking 2023 : The Consecutive Achievement

We are honored to be ranked in various tiers in the Asian Legal Business (ALB) for IP Ranking Firms in Thailand for year 2023.

Tier 2: Copyright and Trademarks

Tier 3: Patent

This year marks the second year of success for ILAWASIA Co., Ltd., as one of Thailand’s notable IP firms.

As the Asian region reopens after three years of the COVID-19 pandemic, the role of intellectual property remains more important than ever.

This is reflected the outcome of our IP service, which have kept our standards when it comes to servicing clients in these time of transition.

The announcement has been notified at this link: bit.ly/3ImPpeo

Myanmar’s Top 20 IP Experts 2022 revealed

Htar Su May is senior associate of ILAW MYANMAR CO., LTD. (ILAWASIA’s Myanmar office),

Recently, Daw Htar Su May has successfully completed the Representative Training Course, certified by Myanmar Ministry of Commerce, Department of Intellectual Property.

With her exceptional expertise, she is not only providing legal advices and services on behalf of ILAW MYANMAR CO., LTD. but also reinforcing the firm’s reliability, and our clients’ trust.

Find out more information at : https://asiaiplaw.com/ip-expert/myanmar/htar-su-may

World Litigation Forum 2023

On May 23-24, 2023, Somphob Rodboon (Managing Partner); Vicheka Lay (Partner); Kridtaporn Sirisereephap (Senior Associate); Kanyamol Phupapiew (Senior Associate); and Nannapas Phatcharakeatkanok (Senior Associate), attended the World Litigation Forum 2023 as exhibitor and sponsor of an event, at the Chengal Ballroom of Crowne Plaza Changi Airport, Singapore.

We are honored to be a part of this global gathering of litigators, arbitrators, attorneys, legal professionals, and practitioners. Let us embrace the power of collaboration and work together to advance the art of litigation and dispute resolution.

Business Visitation of IP Firm

On May 22, 2023, Franco de Barba, European Trademark Attorney, MERX IP, visited our ILAWASIA office in Bangkok to meet Intellectual Property Team, in order to greet on behalf of the firm; and to share business development opportunities in the Asia-Pacific region.

More updates at INTA Annual Meeting 2023

Vicheka Lay, Thanapha Phetkeereeskul, Viphavanh Syharath, and Thamolwan Insawang on the International Trademark Association (INTA) Annual Meeting 2023, in Singapore.

We had a fantastic time meeting IP colleagues from all over the world, reconnecting with friends, fostering businesses, and exploring new opportunities! #INTA2023

INTA Annual Meeting 2023

#EventAttendance

Our IP attorneys, Miss Thanapha Phetkeereeskul (Senior Associate); and Miss Thamolwan Insawang (Associate) are ready to meet all IP practitioners, colleagues, friends and new people at the INTA annual meeting 2023!