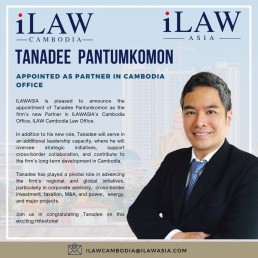

Tanadee Pantumkomon Appointed as Partner at ILAW Cambodia Law Office

ILAWASIA is pleased to announce the appointment of Tanadee Pantumkomon as the firm’s new Partner in ILAWASIA’s Cambodia Office, ILAW Cambodia Law Office.

This strategic addition further enhances our leadership team and reinforces our commitment to delivering exceptional legal services across the region and the global.

In addition to his new role, Tanadee will serve in an additional leadership capacity at the Cambodia office, where he will oversee strategic initiatives, support cross-border collaboration, and contribute to the firm’s long-term development in Cambodia.

With a distinguished background in international legal practice and extensive experiences more than a decade, Tanadee brings valuable expertise and insight to the firm. His appointment reflects ILAW Cambodia Law Office’s commitment to nurturing leadership that bridges legal systems and cultures across Southeast Asia.

“Tanadee’s expanded role is a reflection of his outstanding contributions and our confidence in his ability to lead,” said Somphob Rodboon, Managing Partner of ILAW Cambodia Law Office. “His experience and vision will be instrumental in driving our growth and delivering exceptional service to our local and international clients.”

Tanadee has played a pivotal role in advancing the firm’s regional initiatives, particularly in corporate advisory, regulatory compliance, M&A, cross-border investment, and energy, power and major projects.

In his new capacity, he will focus on enhancing client engagement, mentoring legal professionals, and expanding the firm’s presence in Cambodia.

“I am honored to take on this expanded role and contribute to the continued success of ILAW Cambodia Law Office,” said Tanadee Pantumkomon. “I look forward to working with our Cambodian team to support our clients and strengthen our position in the country to the region, and to the global.”

This appointment underscores ILAW Cambodia’s ongoing commitment to legal excellence, innovation, and leadership across the ASEAN region.

Kridtaporn recognized as a Future Star in the Benchmark Litigation 2025 rankings.

Congratulations to our Litigation Senior Associate, Kridtaporn Sirisereephap, on being recognized as a Future Star in the prestigious Benchmark Litigation Asia-Pacific 2025 rankings.

This recognition highlights her outstanding legal acumen, dedication to client advocacy, and notable contributions to complex dispute resolution matters. Ms. Kridtaporn is one of only 21 legal practitioners in Thailand to receive this honor, reflecting her growing reputation and exceptional performance in the field of litigation.

#BenchmarkLitigation

Somphob recognized as Trade Mark Star 2025 by IP Stars,

We are proud to announce that Mr. Somphob Rodboon, Managing Partner of ILAWASIA Co., Ltd., has been recognized as a Trade Mark Star for 2025 by IP Stars, a prestigious publication under Managing IP.

This marks his second consecutive year receiving this honor, following his recognition in 2024. The accolade reflects his continued leadership, and contributions in the field of intellectual property law, particularly in trademark practice across the region.